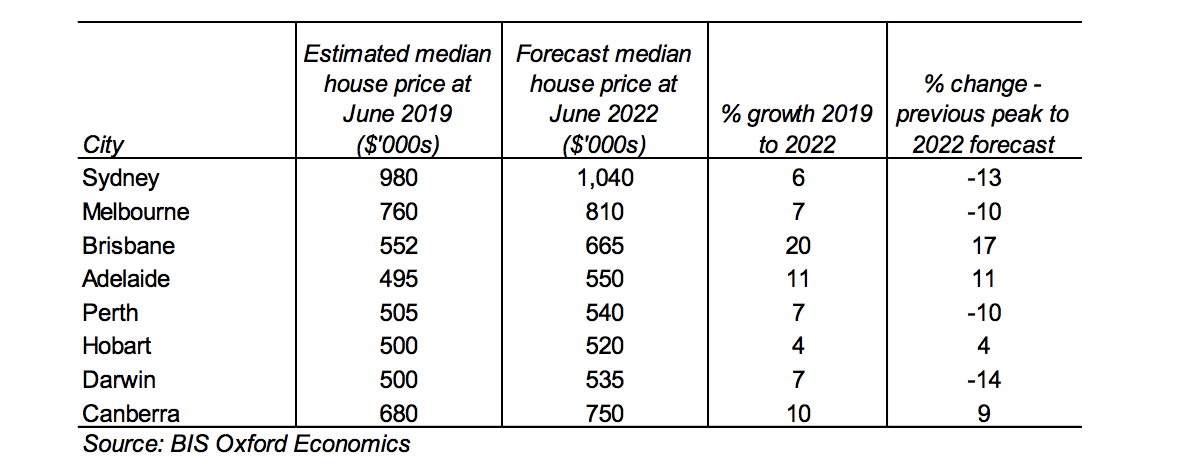

Brisbane house prices could rise up to 20 per cent over the next three years, the largest increase in national house prices for the period, according to BIS Oxford Economics.

The economic forecaster expects the increase in Brisbane’s median house price over the three years to June 2022, although it anticipates most of this growth to be recorded toward the end of this period.

A total rise of 6 per cent is forecast for Sydney’s median house price, and Melbourne could see 7 per cent for the three years to June 2022.

While the downturn in Australia’s residential market is “approaching bottom”, BIS Oxford Economic’s latest Residential Property Prospects 2019 to 2022 report adds that any “meaningful recovery remains a way off”.

The latest forecast, follows on from Moody’s Analytics last month which expects modest rising in Sydney and Melbourne markets in 2020, with the housing price downturn expected to trough in the third quarter of this year.

BIS expects greater challenges in the unit market in the coming years.

“With new apartment construction rising at a much greater rate than houses through the upturn in new dwelling supply, and investors fuelling most of this growth, the excess supply is expected to be more concentrated within the apartment sector rather than houses,” the report notes.

“House price growth across most markets is forecast to barely pass inflation over the next three years, although prices are expected to accelerate across most capital cities by 2021-2022 as the current downturn in supply hits home.”

Report author Angie Zigomanis says supply is running at record levels, with most state markets in oversupply, with some “at best” close to balance.

“The fall-off in purchaser demand is now translating to a decline in new dwelling commencements, which are expected to fall from their 2018/2019 peak to a low of 163,000 dwellings by 2020/21.

“This downturn in new supply will sow the seeds of the next cyclical upturn.”

Capital city forecast: Median house price growth 2019 to 2022

Sydney

Sydney’s median house price is forecast to rise 6 per cent over the three years to June 2022.

“House price growth is expected to stabilise through 2019/2020 as affordability improves and credit conditions ease,” Zigomanis said.

While the median unit price is forecast to rise by only 1 per cent in this time, largely due to tightened credit and demand from investors impacting on supply.

“However, with supply falling away sharply from 2020/2021, the market is expected to tighten quickly and see price growth accelerate beyond the forecast period,” the report notes.

Nearby regional markets Wollongong and Newcastle are forecast to record median house price rises by 5 per cent and 9 per cent in the three years to June 2022.

Melbourne

BIS expects high levels of supply to constrain Melbourne’s housing prices in 2019 and 2020.

“As dwelling completions fall away rapidly from 2020- 2021 price growth is expected to return, particularly given Melbourne’s strong population outlook,” the report notes.

“A more constrained lending environment, particularly towards investors, is expected to contain total growth in the median house price to 7 per cent in the three years to June 2022.”

Due to new supply concentrated in the unit sector, BIS forecasts a “more moderate” aggregate rise of 4 per cent for unit prices for the period to 2022.

Is it Brisbane’s time?

The greatest upside to house prices is expected in Brisbane, although BIS says this upswing will not be immediate.

“Price growth in the unit sector is expected to take longer to return, with a 14 per cent rise in the unit median forecast.”

Across the coasts, BIS expects the Gold Coast to record price growth of 9 per cent while the Sunshine Coast would see a 7 per cent upswing for the three year period, largely due to low vacancy rates but rising supply.

Moderate price rises are expected in Canberra and Adelaide.

Canberra’s median house and unit prices are both forecast to increase by 10 per cent over the next three years.

Adelaide is experiencing ‘goldilocks’ conditions, with no excessive population growth, not too excessive supply, and a relatively affordable market. As such, house and unit prices are expected to rise 11 per cent and 6 per cent, respectively.

Hobart’s hot run is expected to slow down, with rising supply to offset price pressures. BIS expects Hobart’s price growth to be limited over the next three years.

While Perth and Darwin markets have already experienced large declines in prices, BIS says that by 2021-2022, dwelling stock is expected to be absorbed, setting the scene for stronger price rises to come.

Source: https://theurbandeveloper.com/articles/australias-residential-market-approaching-bottom-bis-