It’s no doubt Australian’s love property. We love discussing, renovating, building, looking at and buying property. It’s also undeniable we love investing in property, with about two (2) million or 21% of Australian households holding an investment property. This number has increased by 13% over the last five years.

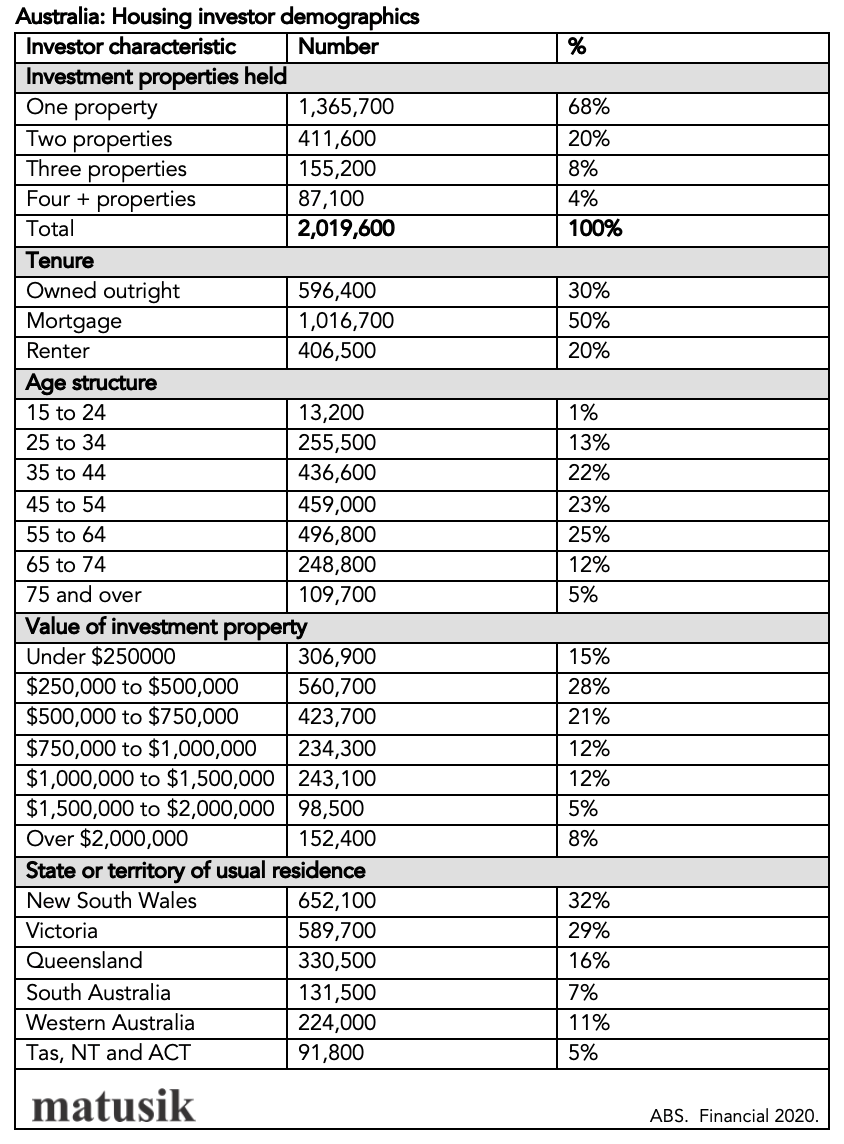

Property Commentator Michael Matusik explains that of the two million investor households, some 68% hold just one investment property, whilst 20% hold two. When looking at the total 9.7 million Australian households, 14% hold one investment home, 4% hold two, 2% hold three and just 1% or 87,000 households hold four or more investment properties.

About half of the growth in investment households over the last five years, has been in households holding two investment properties and another 25% of the lift has been in households holding three investments.

The table below shows that homeowners hold 80% of the investment properties and 20% of renters hold an investment property. Not surprising, housing investments are mainly held by older residents.

Many investment properties are estimated to be worth around $500,000, yet there is a wide range in appraised values. Also, numerous property investors live in New South Wales (32%) and Victoria (29%).

One thing that was a surprise in this recent ABS release – and it is something that they haven’t monitored before – is that around 29% of investment properties are not rented out. They are sitting there vacant. So, whilst there are about two million investment properties across Australia (as at 2020) only 1,442,000 hold tenants and a big 577,000 are sitting vacant. Somewhat amazing is that 170,000 of these 577,000 vacant investment properties are held by renters. This implies that 42% of the investment properties currently held by those renting are unoccupied.

This goes some way to explain why vacancy rates have plummeted in recent years. As I have written about before – and especially assuming that these figures ring true (remember they are the results of an ABS survey) – something should be done to discharge these underutilised homes. A stick could work. An annual tax or separate charge for empty homes are two examples. But maybe a carrot would be better. A tax break or rental supplement maybe. Yet, once price growth slows down and even reverses for a time, then maybe these landlords without a tenant will seek a rental yield instead of relying solely on capital gains. Rising interest rates should also see more investors seek a rental return to help cover holding costs.

Source: Matusik Missive, 7 June 2022